Mini Mobile ATM,In today’s fast-paced world, we all rely on quick, efficient access to cash whenever the need arises. But what if you find yourself in a remote area, far from the nearest bank or traditional ATM? Enter the Mini Mobile ATM – a cutting-edge solution that ensures cash access no matter where you are. This article explores everything you need to know about mini mobile ATMs, from their technology and benefits to their applications and future potential.

1. What is a Mini Mobile ATM?

Understanding the Concept of a Mini Mobile ATM

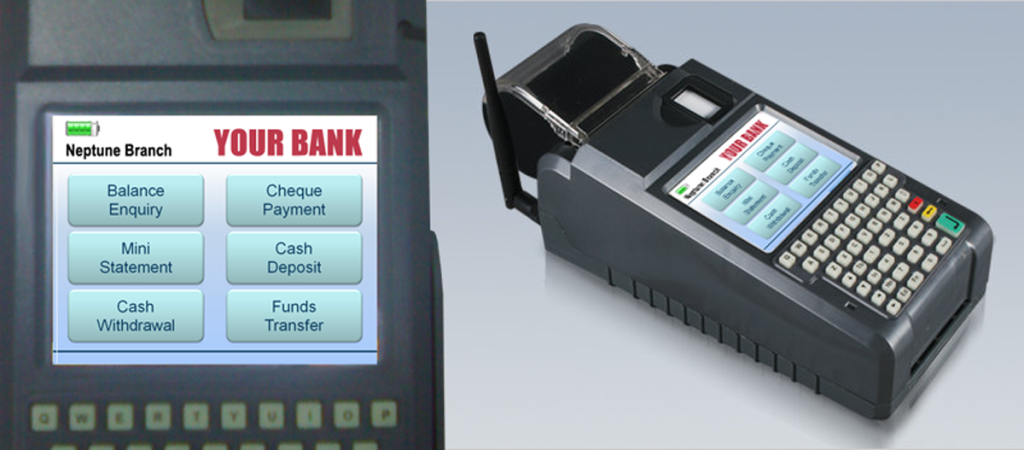

A Mini Mobile ATM is a compact, portable Automated Teller Machine (ATM) that can be easily moved from one location to another, providing banking services on the go. Unlike traditional ATMs, which are often fixed at specific locations like bank branches, shopping malls, or gas stations, mini mobile ATMs are designed to be flexible and accessible in areas where access to cash might be limited.

These machines are equipped with the same functionalities as their larger counterparts, including cash withdrawals, balance inquiries, and other essential banking services. However, they are much more convenient for deployment in places like rural areas, events, festivals, or emergency situations where large-scale infrastructure is lacking.

How Does a Mini Mobile ATM Work?

Mini mobile ATMs are essentially mobile devices that connect to a bank’s central network. They are often mounted in specially designed vehicles, trailers, or kiosks, making it possible for them to travel to different locations. Most mini mobile ATMs are connected to cellular or satellite networks, ensuring a seamless transaction process, even in remote areas.

These machines are designed to handle a variety of transactions and come equipped with safety features such as encryption, multi-factor authentication, and real-time monitoring to prevent fraud.

2. Advantages of Mini Mobile ATMs

Convenience for Remote Locations

One of the main advantages of mini mobile ATMs is the ability to serve areas that are otherwise underserved by traditional banking infrastructure. In many developing countries or rural areas, the distance to the nearest bank can be long, and access to ATMs might be limited. With a mobile ATM, residents of remote areas can easily access cash, improving their overall financial inclusion.

Perfect for Events and Festivals

Another major benefit is the flexibility mini mobile ATMs offer for events. Festivals, concerts, sports events, and trade shows often attract large crowds, and the demand for cash withdrawal can be overwhelming. Deploying a mobile ATM at such events can significantly enhance customer experience by offering convenient and on-site access to cash.

Cost-Effective Solution for Business Owners

For businesses looking to offer ATM services but not willing to invest in the hefty installation costs of a traditional ATM, mini mobile ATMs present a cost-effective alternative. Business owners can rent or purchase a mobile ATM unit and take it to high-traffic areas, where they can generate a steady stream of income through transaction fees.

3. Technology Behind Mini Mobile ATMs

Hardware Components of Mini Mobile ATMs

Despite their small size, mini mobile ATMs are equipped with all the necessary hardware to perform transactions efficiently. Key components include a card reader, cash dispensing mechanism, touchscreen interface, and a secure communication system. These ATMs are built to withstand harsh weather conditions, making them durable and suitable for deployment in a variety of environments.

Connectivity and Communication Systems

For a mini mobile ATM to function smoothly, it needs to be connected to the bank’s network in real-time. This is achieved through mobile data networks, satellite systems, or a combination of both. These communication systems ensure that the ATM can verify and process transactions securely.

Security Measures in Mini Mobile ATMs

Given that mobile ATMs operate in public spaces, security is a major concern. To address this, mini mobile ATMs are equipped with advanced security protocols, including data encryption, two-factor authentication, and video surveillance. Furthermore, most mobile ATM vendors offer remote monitoring, so they can detect and resolve any issues as soon as they arise.

4. Applications of Mini Mobile ATMs

Banking for the Unbanked

In many regions, especially in underdeveloped countries, access to traditional banking facilities is limited. Mini mobile ATMs bridge this gap by offering banking services to the unbanked population. These ATMs are deployed in underserved areas, providing people with the ability to withdraw money, check balances, and even make transfers, without the need for a nearby bank branch.

Disaster Relief and Emergency Situations

In the aftermath of natural disasters, such as earthquakes, floods, or hurricanes, traditional banking services can be disrupted. Mobile ATMs can be deployed quickly to disaster-stricken areas, providing emergency cash access to affected communities. This ensures that people can still access their funds, even when the traditional banking infrastructure has been damaged or is inaccessible.

Mobile ATMs for Businesses and Markets

For businesses that require frequent cash withdrawals or exchanges in various locations, mini mobile ATMs can be a lifesaver. Vendors, market owners, and mobile businesses can deploy these ATMs to offer convenient financial services to their customers, as well as ensure smooth day-to-day operations for themselves.

5. Challenges and Limitations of Mini Mobile ATMs

Security Concerns

While mini mobile ATMs are equipped with advanced security features, they are still susceptible to theft or vandalism. As these ATMs are mobile and can be easily moved, they are more vulnerable to attacks than traditional, stationary ATMs. Ensuring the security of the machines during transportation and on-site is a significant challenge.

Limited Cash Handling Capacity

Mini mobile ATMs, due to their compact size, typically have a limited capacity for cash storage. This means they may need to be restocked more frequently, especially in high-traffic areas or during events. Managing cash supply and ensuring that the machines never run out of cash is crucial for maintaining smooth operations.

Connectivity Issues in Remote Areas

While mini mobile ATMs rely on mobile or satellite connectivity, there may still be areas where the signal is weak or unreliable. In such cases, transactions could be delayed or fail, creating frustration for users. Continuous monitoring of the network connections is required to ensure consistent service availability.

6. The Future of Mini Mobile ATMs

Integration with Digital Payment Systems

The future of mini mobile ATMs is likely to be shaped by the integration of digital payment systems. With the growing adoption of mobile wallets, cryptocurrencies, and contactless payments, mini mobile ATMs may evolve to accept a wider range of payment methods, allowing customers to withdraw or transfer funds digitally, as well as access traditional cash.

Expansion to Emerging Markets

As banking penetration increases in emerging markets, mini mobile ATMs could play a key role in fostering financial inclusion. These devices offer a low-cost, scalable solution to reach large populations in areas that lack traditional banking infrastructure.

Advances in ATM Design and Functionality

Ongoing advancements in ATM technology, including the use of artificial intelligence and biometric authentication, may lead to more intelligent and secure mini mobile ATMs in the future. These machines could be equipped with more advanced features such as facial recognition, voice commands, and predictive analytics to offer a more personalized user experience.

7. Mini Mobile ATMs in the Modern Economy

Enhancing Customer Experience

In today’s consumer-centric economy, businesses must prioritize customer experience to stay competitive. The presence of a mini mobile ATM at strategic locations can improve customer satisfaction by providing on-the-spot access to cash, making transactions more seamless and reducing the hassle of looking for a nearby ATM.

Boosting Financial Literacy and Inclusion

By making banking services more accessible, mini mobile ATMs can play a vital role in improving financial literacy and inclusion, especially in developing regions. Providing basic banking services in remote areas not only helps people access cash but also educates them on the importance of managing finances and building credit.

Conclusion: The Future of Mini Mobile ATMs is Bright

Mini mobile ATMs are an innovative solution to a wide range of challenges in today’s fast-paced, cash-driven world. With their ability to provide convenient access to banking services in remote areas, at events, and in emergency situations, these compact machines are proving to be invaluable assets for individuals, businesses, and communities alike. As technology continues to evolve, the future of mini mobile ATMs looks promising, with improvements in security, functionality, and connectivity expected to further enhance their utility.

Expansion Sections for Further Detail:

- Mini Mobile ATM Market Trends

- Key Players in the Mini Mobile ATM Industry

- Case Studies of Successful Mini Mobile ATM Deployments

- The Environmental Impact of Mini Mobile ATMs